During the pandemic, AMD was forced to switch to a more pragmatic model of production. In contrast to the company’s traditional focus on the desktop DIY market, the chipmaker adopted a high-margin notebook-first (and server) approach, much like its rival. As a result of this, while the overall processor shipments took a hit, the profits continued to rise.

The consequences are quite clear. Intel managed to gain some desktop CPU market share for the first time since the launch of the Ryzen 3000 lineup. On the other hand, the notebook market continued to favor AMD, with Ryzen processors powering more than 20% of all notebooks shipped this year.

This trend is expected to continue in 2022 with AMD’s market share slumping to just 15% by the end of the year. Intel’s desktop CPU share is expected to return to pre-Ryzen 3000 figures through the next few quarters.

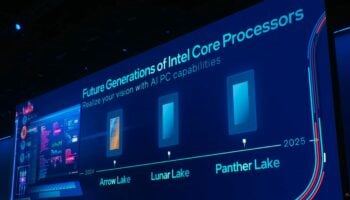

Feedback on Intel’s next-generation Alder Lake CPU has been much better than expected. Feedback from ODMs indicates the performance of Alder Lake has been much better than expected with performance +50% vs. Intel’s prior generation Tiger Lake. Additionally, the pricing of Alder Lake is only expected to be 10% higher than Tiger Lake. Alder Lake’s performance is also viewed as superior, as compared to AMD’s recently announced Ryzen 6000 CPU. ODM partners are expecting that INTC will be able to regain significant market share in desktop PCs vs. AMD.

Expect the 2022 PC market share between AMD and INTC to remain stable. We expect PC market share between AMD and INTC to remain relatively stable in 2022 with INTC share expected to be 79-80% and AMD share expected to be 20-21%. With the improved performance of INTC’s Alder Lake, we expect INTC to regain market share in desktop PCs with shares expected to increase from 77-78% in 2021 to 85% in 2022. We expect this to be offset by continued share gains by AMD in Consumer PC NBs, with shares expected to increase from 23% in 2021 to 28-30% in 2022. With AMD remaining supply-constrained particularly in ABF substrate, we believe the Company is prioritizing share gains in servers and PC NB vs. desktop.

In the notebook market, AMD just launched its Ryzen 6000 “Rembrandt” processors featuring the RDNA 2 graphics architecture, and LPDDR5 memory. Although a notch below Alder Lake-P in terms of CPU performance, these APUs offer solid graphics/gaming capabilities, marking the launch of the first iGPUs with hardware-accelerated ray-tracing.

On the desktop side, however, things have been rather quiet. The budget and lower-end segment are completely under Intel’s thumb, with the last Ryzen 3 offering launched more than two years back. The only major DT CPU launch is the Ryzen 7 5800X3D, but going by rumors, it might launch in limited numbers. Intel just launched its 12th Gen Alder Lake lineup and plans to launch the 13th Gen Raptor Lake family by the end of the year. AMD’s fortunes in the desktop market should improve by the last quarter of 2022 as the company launches its 5nm Zen 4 based Ryzen 7000 CPUs.

Expect AMD server market share to increase to over 20% this year. Feedback from the server supply chain indicates that AMD’s market share reached 11-12% in 2021 and will this year reach 20%, particularly at cloud providers Facebook and at Microsoft Azure. In our November cloud instance tracker, we observed an inflection in new AMD instances (link to November cloud instance tracker note) and expect this momentum to continue. We also see a significant runway for AMD to grow market share at Facebook, as the Company’s share is still relatively low at a LSD percentage.

AMD’s Genoa still expected to launch in 4Q22. We maintain that AMD’s next-generation server CPU will be launched around the end of 2022 with mass production expected in 1Q23. This is delayed from the original launch date of mid-2022.

Things are much better for AMD in the server segment. The company managed to cross the 10% (some reports saying 15%) mark in 2021 and is expected to record similar gains in 2022. As per this report, Epyc processors will reach a market share of 20% this year, especially in the cloud space. The launch of the 96-core Epyc Genoa and 128-core Bergamo processors will further bolster the momentum towards the end of the year.