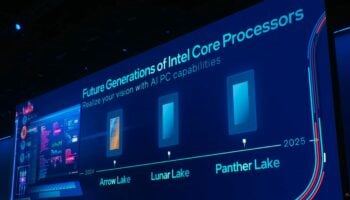

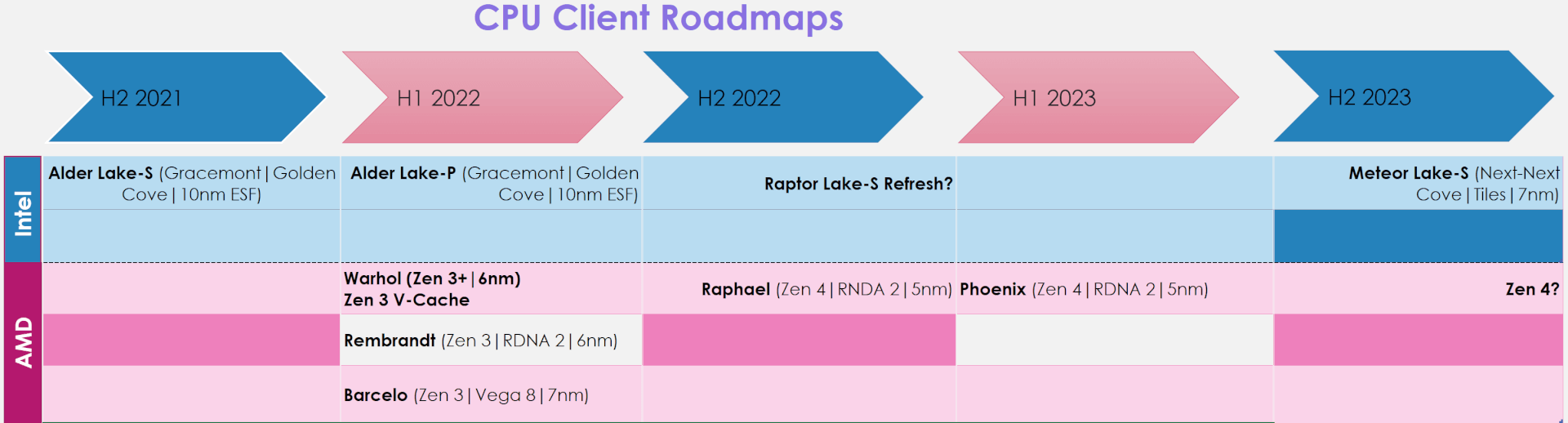

Intel made a lot of interesting announcements during its second-quarter earnings call. I’ll be highlighting some of the noteworthy points that were missed by a lot of other outlets. The most noteworthy point from the call was that Meteor Lake which will be Intel’s first 7nm processor with a tiled/chiplet design will begin production in 2023. I’m assuming that we’re talking about the first half of the year, and that would mean that the launch should come sometime in late 2023 or early 2024.

Going by that, it looks like Meteor Lake would land directly alongside AMD’s Zen 4-based parts, most likely a few quarters earlier. From what we’ve heard, AMD has a lot of Zen 4 lineups in the works, including Strix Point, a heterogeneous core design.

Moving on, Intel CEO Pat Gelsinger also stated that the chipmaker’s 10nm capacity has overtaken 14nm production with manufacturing costs for the former down 45% year-on-year. This is good news as it’ll help keep the profit margins in check, especially since all of the company’s chips are based on 10nm-class nodes.

There was also talk of Intel’s investments into growing the IDM 2.0 initiative. Gelsinger said to expect news on European foundry investments by the end of the year. This is in addition to the $20 billion foundry investment in Arizona, $3.5 billion in New Mexico, and another few billion in Ireland and Israel. The U.S. Innovation and Competition Act should provide some of the capital to bring these plans to fruition.

On the financial side, Intel’s profit margins (operating income) fell down across the board. In the Client Computing Group (CCG), Operating income was $3.8 billion, up 32% year-over-year on higher revenue, lower inventory reserves, and reduced 10-nanometer costs. DCG revenue was $6.5 billion, down 9% year-over-year due to increased competition from AMD’s Epyc Milan and Rome-SPs. Overall, the operating income was down by $151 million YoY, from $5,697 million in Q2 2020 to $5,546 million this year.

Although the Data Center Group saw a growth of 16% QoQ, the Operating income was down by 37% YoY due to increased competition and the 10nm production ramp. The gross margin is expected to be roughly 55%, once again falling by 150 basis points YoY, primarily due to the 7nm production ramp-up.

Overall, Intel’s Q2 earnings report shows that the chipmaker is enduring, but the competition is continuing to heat up while manufacturing costs are also growing steadily. It’ll be interesting to see how this affects the process roadmap expected to be revealed on Monday.