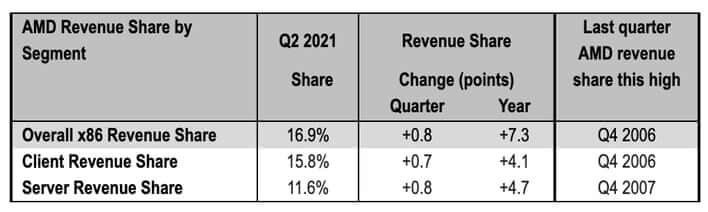

Just the other day, we shared AMD’s gains in the CPU market over the last year in terms of the overall revenue share. Suffice to say, the chipmaker has been making the most money it has in more than a decade. This has, however, come at a cost. The semiconductor shortages have forced AMD to focus where the dough is: The server and the mobile (laptop) CPU markets. Company CEO Dr. Lisa Su said as much in an interview during the Q2 earnings call, and it shows:

Speaking about the company’s phenomenal second quarter wherein it managed to double the revenue and triple profitability, she said that they have been focused on the “most strategic segments of the PC market”. These include notebooks, gaming notebooks, premium consumer notebooks, and commercial notebooks. The same can be said about AMD’s Epyc Rome and Milan processors. Over the last six months, we’ve been seeing ample adoption of the Epyc-SP among cloud providers, most notably Google, Amazon, as well as several universities. In fact, 9 Out of 10 Most Energy Efficient Supercomputers are Powered by AMD’s Epyc CPUs.

In the desktop “DIY” space, however, this has resulted in fewer budget SKUs as more and more are dedicated to the mobile/server segments, and the higher-end CPU stacks. As the bulk of consumer processor sales take place in the budget space, this has resulted in fewer AMD shipments over the last year. AMD’s desktop PC share fell by -2.3% QoQ and -2.1% YoY. However, a focus on high revenue segments meant that the client revenue in the same period grew by +0.7% QoQ, and 4.1% YoY.

Competition in the mobile market has been much more severe, with Intel making the bulk of mainstream machines. AMD managed to gain ~2% of the CPU share compared to the last quarter and a minute +0.1% YoY.

In the server segment, things have been much more dynamic, with AMD gaining +3.7% share compared to the same period last year, and +0.6% QoQ. The company now controls approximately 10% of the market in the server space.

Via: Twitter (Dylan)