Usually, when we talk about Intel and AMD and how the two chipmakers compare concerning their positions in the CPU market, we primarily look at the market shares. However, there are a few other metrics that underline a company’s recent performance and position. These include the gross margins, profit margins, net debt, operating profits, etc. Over the past 4-5 years, AMD has been reclaiming its lost shares across the board: desktop, DIY, mobile, and server.

At the end of the second quarter of 2021, AMD’s share in the client segment stood between 20-25%, depending on who you ask and how you calculate the market share. This includes the desktop (DIY and OEM) and mobile (gaming notebooks, ultrabooks, enterprise, etc) markets, primarily representing the performance of the Ryzen CPUs and APUs. Lately, the company has been focusing on strategic segments such as mobile and server, as is evident from Mercury’s figures.

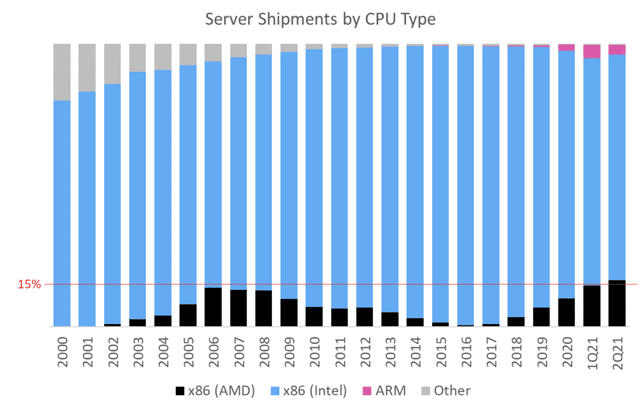

According to research firm Omdia, AMD has already garnered a larger market share position in the server market than back in 2006 (during the heyday of the Opterons). In Q2’21 their share of server CPU shipments topped 15% of the market and topped the prior peak of 14% in 2006.

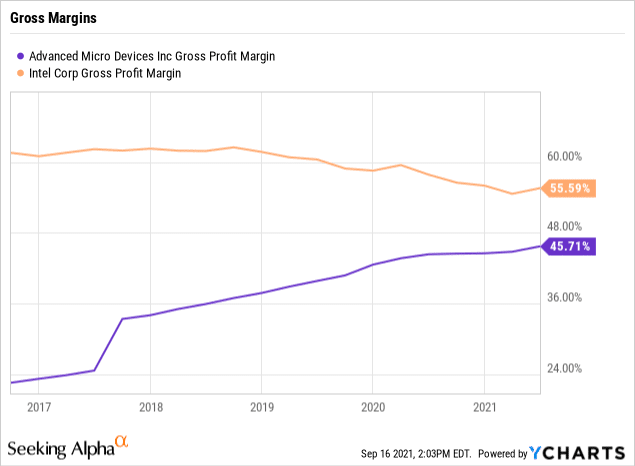

This is reflected directly in the gross margins of the two companies. As AMD ramped up its attack on the mobile and server markets, its margin increased by nearly twice while Intel’s margin began to decay. We’re looking at an increase of more than 20% in four years for the former.

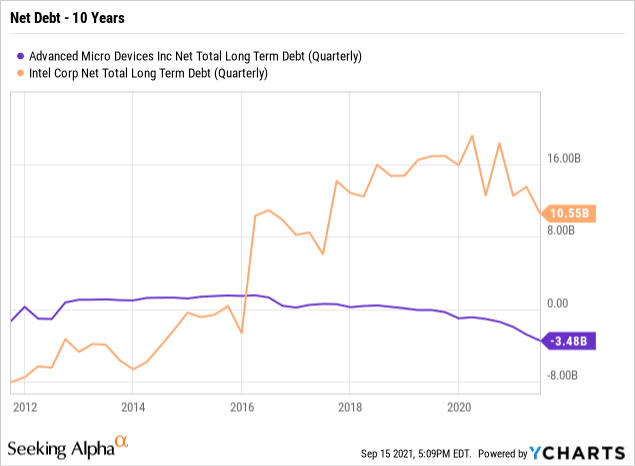

Similarly, the net debt for AMD also dropped under zero in late 2019 while Intel began steadily piling it up ever since. The latter went from negative $3 billion to over positive $10.55 billion in just over four years. That’s pretty insane. All this can’t be attributed to AMD’s comeback and is the result of multiple factors such as 14nm shortages back in 2018-19, 10nm delays/defects, increased R&D costs, etc. Things haven’t been very rosy for Intel at the end of the day. (Fabulouseyebrowthreading)

Now, coming to the price war, it would also seem that that’s hurting Team Blue more than Red, especially in the server space. We’ve seen plenty of Cloud and Edge providers adopt AMD’s Epyc chips over Intel’s Xeons over the past year, including Cloudflare, NetFlix, etc for improved performance at a reduced cost (both power and economic).

As you said pricing is not the first order variable when you’re buying a server CPU it really is about total cost of ownership. I think the performance leadership that we have, is clearly there, and I think customers see that.

So, we will – we’ll always fight for every socket. I mean that we’re very competitive in that fashion. But we think that the way to do that is with the strength of the roadmap and the strength of the deep partnerships, and price is sort of a second order lever in this market.

Dr. Lisa Su, AMD CEO

Much of this boils down to how AMD makes its chips versus Intel (fabless vs IDM), target markets (fewer but more focused), investor confidence (stock grew by 2x since 2020), and last but not the least, a clearer roadmap with near-flawless execution and a higher perf/$ mix.