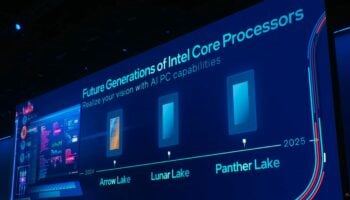

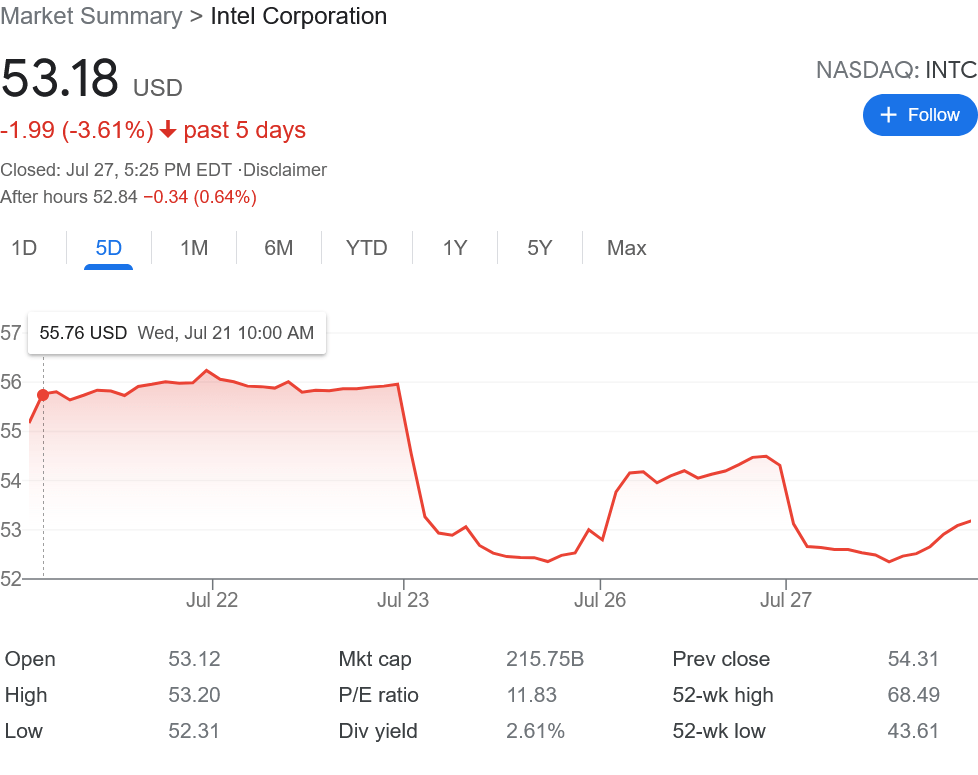

At the Intel Unleashed event, the chipmaker made some major changes to its roadmap, though most of them were simply PR-oriented. The process nodes have been updated to bring them on parity with rival TSMC’s offerings, while major strides in terms of packaging technologies have also been made. However, all this wasn’t enough to satisfy stockholders. Intel stocks fell by nearly 4% shortly after the webstream, as analysts voiced concerns over the market losses and execution challenges ahead.

Wedbush congratulated the Intel management for “reinvigorating the roadmap”, but expressed concern over increasing costs during periods of underperformance. At the same time, the firm expects Intel to continue losing share into 2023, as it struggles to achieve technology parity if the roadmap holds that is. Wedbush maintains an Underperform rating and a $50 price target.

Credit Suisse has set its rating to Outperform with a stock target of $80. Also voicing concern that Intel failed to provide the financial implications of the roadmap (leaving those details for the analyst day, November), the firm thinks “investors will not underwrite an improving narrative until estimates have been ‘de-risked’.”

Finally, Benchmark expects Intel to lag behind the competition till 2024, stating that, “The first step in solving a problem is admitting you have one”. The firm noted that the change to the process node naming scheme will provide “healthy assistance” to make the roadmap look more substantial.

Analyst quotes from Seeking Alpha.