The colors of the microprocessor industry seem to be inverting, with Intel strengthening its grip over the desktop CPU market but consistently losing market share in the server space. Furthermore, the success of the 13th Gen Core processors paired with the (planned) 2023 Meteor Lake launch indicates that AMD’s position in the client market will get only weaker. Meanwhile, in the data center market, the repeated delays in the launch of the 4th Gen Xeon Scalable processors will do the exact opposite.

13th Gen Raptor Lake vs. Ryzen 7000

Intel’s 13th Gen processors have a lofty performance lead over their Ryzen 7000 rivals in gaming workloads, and the retail market is having a great time with them. The Core i9-13900K has climbed to the third spot on Newegg’s bestselling chart, beating the Ryzen 5 5600X and the i7-12700K. AMD’s Ryzen 9 7950X is the most popular Zen 4 SKU, holding the seventh spot, followed by the Core i7-13700K at #11 and the 7700X at #14.

Mindfactory has long favored the Ryzen family of processors, but the Raptor Lake-S launch has started to skew it in Intel’s favor. The 13th Gen Core i7-13700K, i5-13600K, 13600KF, and the 13700KF are all well ahead of the entire Ryzen 7000 lineup, selling close to 700 units overall. The Ryzen 7000 offerings don’t even break the 300-unit mark, selling half as many.

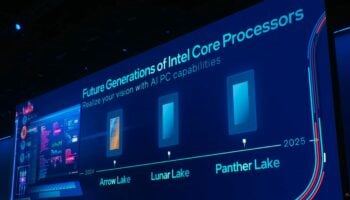

The 14th Gen Meteor Lake family will enter mass production near the end of the year, followed by a launch in mid or late 2023. The core counts will remain unchanged, but Intel will introduce its 4nm process node and two new core architectures, Redwood Cove and Crestmont. AMD already falls short in IPC and single-threaded performance. Two faster cores on a new process node will further widen the gap.

Unless AMD doubles its core counts with Zen 5, it will be a hard battle, especially considering that Intel’s E-cores will be even faster and more optimized for Windows. Furthermore, rumors have claimed that AMD might be forced to stick with N5 for Zen 5, giving Intel a node advantage for the first time in years. The earliest Zen 5 can launch is early 2024 or late 2023. Even then, it will proceed Meteor Lake, at least in the mobility space.

AMD’s Data Center Roadmap: Epyc Genoa, Genoa-X, Bergamo, Turin

The server or data center market was Intel’s fortress of solitude. Since the launch of the (64 core) Epyc Milan processors in 2019, AMD has been taking over it, slowly but steadily. (xanax) The delay of the Sapphire Rapids-SP lineup to 2023 will be a massive blow to the chipmaker’s already bettered data center business. Team Blue’s Q3 data center income was almost nil, and another roadmap blunder certainly won’t help.

Intel’s present condition in the lucrative data center market is at its worse in over a decade. The third quarter profits were down to almost nothing as competition rose in a market stagnant since the days of Opteron. By mid-2022, AMD had already wrestled control of a quarter of the server and enterprise processor market. As a result, AMD’s Data Center revenue share should hit 30% by the end of the year, higher than even the Opteron days.

On the other hand, AMD’s data center segment revenue was up 45% year-over-year, driven by the strong sales of EPYC server processors. The operating income was $505 million (31%) compared to $308 million (28%) a year ago. Alternatively, the client segment revenue was $1.0 billion, down 40% year-over-year due to reduced processor shipments. On the bright side, CPU ASP increased year-over-year, driven primarily by a richer mix of Ryzen desktop processor sales.